Get in touch to see how we can help you optimize your game development or strategy, through deeper player and market understanding. Fill in the form below and we'll get back to you soon.

Unlocking the Value of Consumer Insights

Unlocking the Value of Consumer Insights

At Bryter, we help our gaming clients understand their audience and how to create games players will love, from casual mobile puzzle games, to AAA blockbusters. The following guide highlights the importance of market research for games and key guidelines.

The games market is evolving and growing all the time, so what we think we know about the market is also likely to change. Within the audience of gamers, there are many different types of players, with very different motivations and needs. For example, a solo adventurer who plays open-world A-RPG games to immerse themselves in and explore diverse biomes, versus a social competitor, who is looking for a challenge, a chance to show off their skills before others.

This highlights the importance of conducting market research before investing time and money into a project – firstly to understand the feasibility, and then to help steer development and positioning.

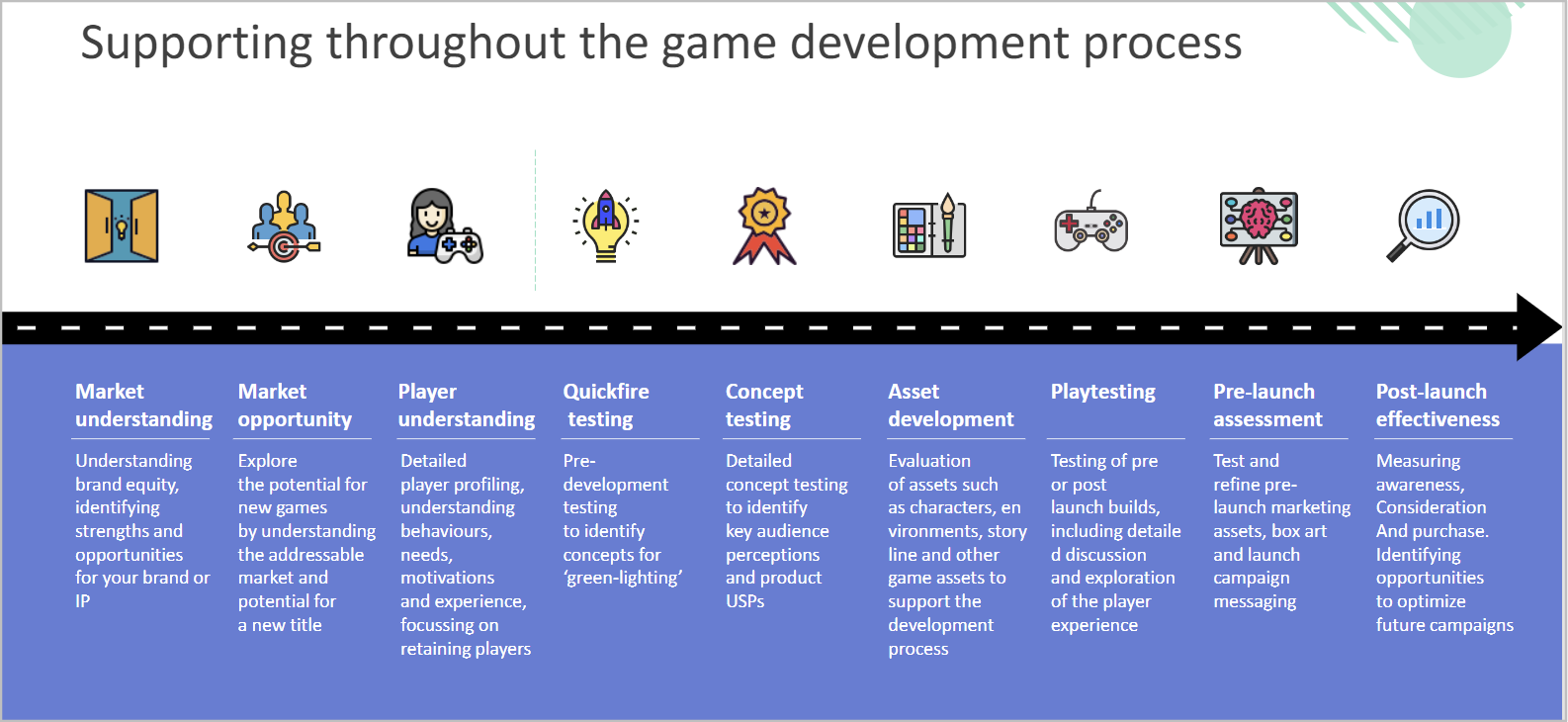

At Bryter, we support our clients throughout the game development lifecycle, helping to understand where the opportunities lie and how best to maximize engagement. From building a market or category understanding, to testing the feasibility and appeal of a new game concept, to preparing a new game for launch, in terms of the gameplay or the marketing strategy.

The first thing to do before conducting any research, is to design a detailed research brief. This is aimed at outlining why there is a need for research, what you hope to understand through the research and how that research will be used within the business.

Often there are many stakeholders or parts of the business involved in the research, and the research brief can ensure that the scope is clear and everyone is on the same page. It is also a very important document to refer back to throughout the research process – to ensure that the business needs are still being met and the research plan isn’t (unknowingly) deviating too much from the original objectives.

Before jumping into conducting primary research, it often helps to take stock of what you know already. In some cases, it may even be that the answer to your problem has already been solved by other research, or at the very least, could help inform how you plan your next primary research.

Secondary data is any research that has previously been collected for other purposes, so can take many forms…

Before creating your research methodology, you will first need to identify who you want to target.

Perhaps you know your target audience well already, or perhaps part of the research objective is to identify them. This will steer the methodology and sampling approach you use.

Target profile: who do you want to talk to? For example, surveying a broad sample of gamers representative of the population, in order to gain a wider market view (useful for markets sizing and concept testing studies) – or focusing on a specific type of players (often when the target audience is already well understood, and the focus is on gaining detailed feedback amongst a relevant audience, for example, playtesting a soulslike game amongst a soulslike audience, rather than including Platformer players who wouldn’t consider the game.

Markets: what are your key markets of interest? Primary market research can require significant cost investment, so you may need to prioritise a smaller number of markets that represent the broad range of behaviors/ cultures. Some things to consider are the importance of each one (e.g. their share of your player base), and whether the markets chosen will reflect an accurate representation of the total player base.

Sample size: how many gamers do you need to target in order to capture robust and meaningful data? As well as having a large enough total player pool, you will need to consider any other subgroups of interest you may need to cut the data by, and whether you will capture enough of these in the overall sample. Also in qualitative research - which typically deals with much smaller sample sizes – it’s important to consider if there are enough of each profile type to identify patterns confidently.

For example, one focus group could consist of eight individual Shooter players but the feedback and opinions within this could be steered by one dominant respondent. Therefore it is always recommended to have at least two groups of each player type.

.jpg?width=1280&height=854&name=pexels-matilda-wormwood-4101334%20(1).jpg)

Once you have outlined the key objectives and the scope for the project, you can decide on the most suitable methodology. Perhaps it will involve more than one stage of research, with each stage informing the next and building a more holistic view. For example, initial exploratory qualitative interviews in order to understand how players perceive a certain category or product, before validating the insights in a robust quantitative survey, and identifying the most significant behaviours.

Types of research:

Consider specific tools or techniques that may add additional layers of insight. Sometimes in a research environment, where respondents make more considered decisions, what they say they feel or would do, can be different from what they actually do. Using advanced statistical techniques such as MaxDiff, TURF and Drivers Analysis, can help go beyond stated importance or preference, and uncover a clear hierarchy of preference and what really drives appeal.

Set out key project milestones, but allow adequate time for each stage. Data can be delivered quickly, but it requires time and exploration to uncover detailed and meaningful insights.

Track progress regularly, but also check topline data to ensure that the story is broadly in line with what you expect.

Most research projects will result in an abundance of data – whether it’s thousands of rows of data, interviews, video selfies, text answers, photos, or a mix of all of these – it can often be overwhelming. For this reason, it is crucial to plan the analysis stage beforehand.

The research plan will help guide the analysis, but you can’t always foresee exactly how the data will fall out. Perhaps the data will develop in a way you didn’t expect, and therefore open up a new path of exploration. For this reason, the analysis stage is an iterative process.

Examples of how Bryter have supported gaming developers and publishers in successfully using market research insights to inform game development or marketing strategies…

Objectives: Firstly, to confirm the primary audiences and understand who they are as gamers; what motivates them and how to reach them. Secondly, to test the overall concept of the game, with accompanying video and artwork assets, in order to identify the most engaging elements and refine the game’s positioning, ready for release.

Methodology: Bryter conducted an online survey with a representative sample of PC and console gamers in the US. As well as key metrics such as take-up and appeal, we used text highlighting and video pulse rating tools to build a detailed understanding of reactions to the assets being tested.

Outcome: By targeting a representative sample of gamers, we were able to measure appetite for the game across the gamer audience, as well as identify specific audiences of interest within this; who they were as gamers and what motivated them most. We were also able to give specific recommendations regarding the positioning of the game – from key phrasing in the description, what to emphasise more or less in the video, and what visual assets to prioritise in marcomms.

Objectives: Understand what drives success in the A-RPG category and how this relates to players’ associations and perceptions of current titles. Building on from this, how can a new title from a previous franchise fit into this – is there still appetite and what does it need to look like.

Methodology: A 3-stage approach, firstly conducting online focus groups with A-RPG gamers in the US, exploring the motivations for playing A-RPG games and what players look for in A-RPG games. This then fed into the design of the next quantitative stage – an online survey aimed at creating a hierarchy of driving factors of A-RPG games and current competitor performance. Lastly, we conducted a second online survey with previous franchise fans and newcomers, specifically exploring appeal and equity of the franchise in question.

Outcome: Using advanced statistical techniques - drivers analysis and perceptual mapping – we were able to create a clear hierarchy of features that drove success in A-RPG category, and how current titles delivered on these. We also identified the key features for a new title, including how strategies may need to differ across the different audiences of newcomers and previous fans of the franchise.

Get in touch to see how we can help you optimize your game development or strategy, through deeper player and market understanding. Fill in the form below and we'll get back to you soon.

Unit A, 3rd Floor, Zetland House, 5-25 Scrutton Street

London

EC2A 4HJ

United Kingdom

Suites 405 & 406, 433 Broadway

New York

NY 10013

United States